This is the third part of our five-part series on Why You Should Treat Wage and Hour Compliance Like Safety in California.

In Part 1 of this series, we discussed how businesses all over the state have learned to manage the risk of violating California’s workplace health and safety laws. From Cal/OSHA to elaborate safety training and prevention programs, a well-established infrastructure exists to minimize health and safety violations and manage exposure to health and safety lawsuits. We contrasted this with the threat of wage and hour lawsuits, which present a greater threat to California employers due to a lack of administrative or preventative infrastructure.

In Part 2 of this series, we shared one reason why wage and hour lawsuits in California can be so devastating to employers compared to health and safety violations. The reason? Health and safety risks often involve a limited number of employees, inherently limiting their potential costs. Wage and hour exposure, however, often involves all your California hourly (non-exempt) employees. Class actions cover every current and former employee for four years or more. PAGA claims go back around a year but have a higher penalty structure.

That’s not the only reason, however, why California employers’ exposure to wage and hour lawsuits often dwarfs the liability from serious safety violations. There are three more.

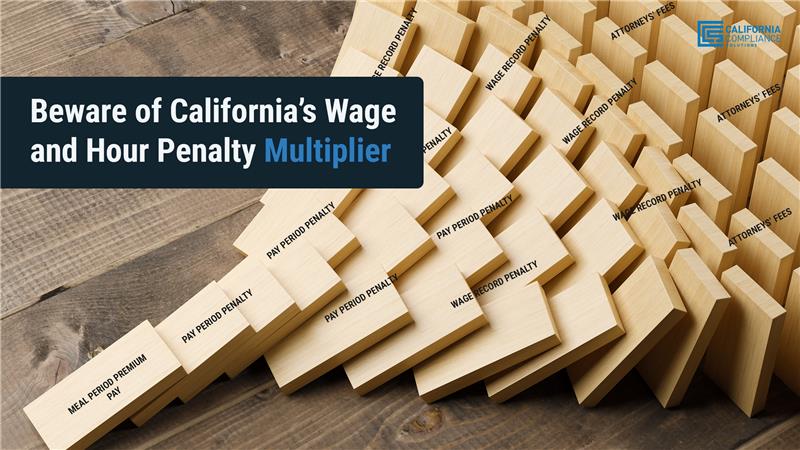

The next thing employers should be alarmed about is astronomically driving up the costs of wage and hour lawsuits. It is California’s wage and hour penalty multiplier (DUN DUN DUN!!! Cue the scary music).

Here’s How Wage and Hour Penalties Add Up So Quickly for California Employers

California’s aggressive wage and hour penalty and remedy laws drive up the potential exposure in wage and hour lawsuits far higher than any safety violation ever will. This is because of the California wage and hour penalty multiplier. California laws are structured to penalize employers by assessing a penalty for each potential wage and hour violation and sometimes stacking penalties upon penalties for the same type of violation for a period that can go back as far as four years.

For example, a single missed, late, or short meal period can trigger the requirement to pay:

- The employee one hour of meal period premium pay;

- A separate penalty of up to $50 per pay period;

- Potential derivative penalties for wage records not being accurate due to the meal period violation; and

- The employee’s attorneys’ fees for recovering these penalties.

In this way, a single meal period infraction can result in $50, $60, or sometimes even $100 of potential exposure per meal period! When facing a class or PAGA action involving hundreds of employees, a single compliance issue with a meal period can become multi-million-dollar exposure. Here are a few real-world examples of how the wage and hour penalty multiplier works (and these are conservative and not extreme examples):

Class Action Example

200 employees per year x 50 weeks per year x 4 years x 1 hour of pay @ $15 x 1 meal period violation per week = $600,000 + potential stacking penalties of $200,000 + derivative wage statement penalties of $200,000 + employee’s attorneys’ fees of $200,000 = $1,200,000.

PAGA Example

400 employees x 26 pay periods x $50 per pay period x 1 violation = $520,000 + employee’s attorneys’ fees of $200,000 = $720,000.

Let’s see how this plays out in a real-life example:

Case Study: Misclassification of Employees at Uber Technologies Inc.

In 2016, Uber, the ride-hailing giant, faced legal scrutiny over classifying its drivers as independent contractors rather than employees. The company considered drivers freelancers, exempting itself from providing benefits such as overtime pay, minimum wage, and expense reimbursement. The lawsuit claimed otherwise.

Uber’s classification of drivers as independent contractors was questioned as drivers argued that they should be classified as employees. The company exerted significant control over various aspects of drivers’ work, including setting fares, performance standards, and the ability to terminate the driver’s relationship with the platform. Affected drivers claimed they were denied basic employment benefits, such as overtime pay and reimbursement for expenses incurred during their work. They argued that the classification as independent contractors deprived them of essential workplace protections and benefits.

The misclassification led to a class-action lawsuit against Uber. In 2016, a settlement was reached wherein Uber agreed to pay up to $100 million to drivers in California and Massachusetts to address the claims related to the misclassification of drivers and provide compensation to the affected drivers.

The settlement amount likely reflected the number of drivers in the lawsuit, the number of pay periods, and an assessment of various penalties and fees for each potential violation.

This is a potent example of how California’s wage and hour penalty multiplier can add up to significant exposure.

It’s Time to Take Wage and Hour Compliance Seriously in California

California employees need to be aware of their exposure to wage and hour lawsuits and start implementing best practices to mitigate their exposure. If you have already been sued in a wage and hour lawsuit, you understand how expensive they can be. If you have not been sued, it’s only a matter of time. Employers must prioritize wage and hour compliance and develop comprehensive, balanced compliance strategies to mitigate the risks associated with wage and hour violations. An excellent place to start? Implement a California compliance plan and start training your employees in wage and hour policies and best practices(just like you probably already do for safety).

Without a good compliance strategy, employers will be easy prey on the rolling plains of the California legal landscape, where Bounty Hunters Are on the Prowl, as you'll discover in Part Four of the series here.